Call Now for a Free Initial Consultation

Call Now for a Free Initial Consultation

Money problems can happen to anyone. From the poorest to the richest, sometimes life can throw a wrench at you and you can find yourself on the streets. Many different situations can lead someone to have to file for bankruptcy. This year (2020), Covid-19 caught us all by surprise. Based on historical and 2020’s data, we attempt to predict what 2021 will look like in terms of bankruptcy filings.

We predict that compared to 2020, the years 2021 and 2022 (and maybe beyond) will see as much as a 100% (double the amount) increase in bankruptcy filings. It could be more. We base this prediction on what happened in the last Great Recession of 2006-2010.

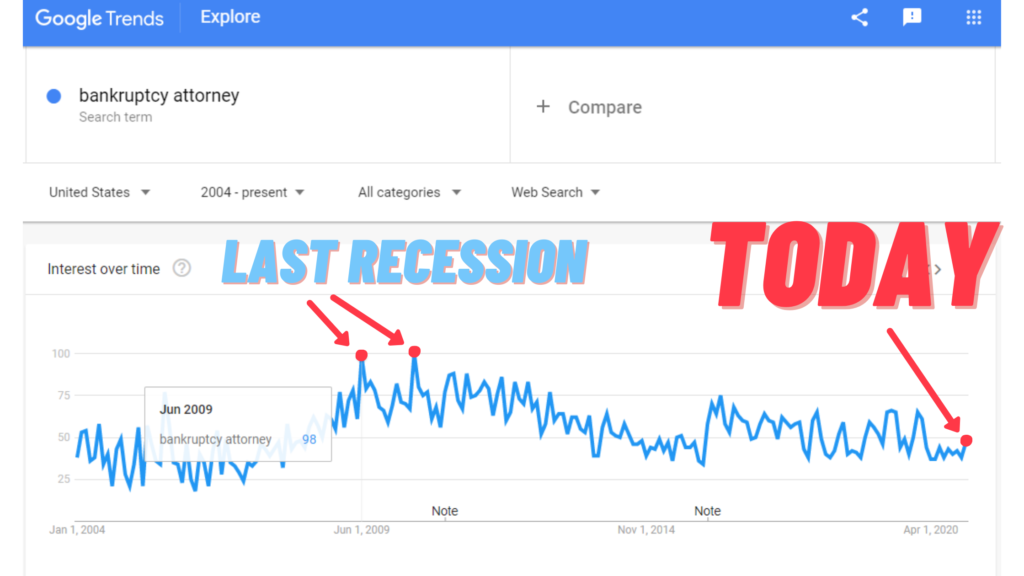

A casual glimpse of Google Trends shows that the amount of people searching for the term “bankruptcy attorney” in the United States doubled during the last recession. We think our “100% increase” number may even be conservative given that the impact of Covid-19 feels greater. The last recession didn’t cause this many people to die, and it didn’t shut down every single restaurant, the entire travel industry, etc.

Before we discuss the most common causes of bankruptcy, it makes sense to first identify the demographic characteristics which bankruptcy filers tend to have in common.

Those who file for bankruptcy are:

The pandemic has not only caused people to quarantine all around the world, it has also stripped businesses of many of their customers. With laws that prevent full capacity for both indoor and outdoors, the lucky restaurants and shops are able to fit in maybe about half their usual capacity to still make enough income to pay rent, employees, and still make a profit. But many others are not so fortunate with space to work with and have to file for bankruptcy and go out of business entirely. Some states and counties (California and Los Angeles to name a couple) are even more strict with lockdowns which place even more stress upon small businesses and the people they employ.

Sometimes life just throws you a wrench and the worst-case scenario unfolds. This can come in the form of a car breaking down, a house that has caught on fire and destroyed years of belongings and many other plights. With many individuals and families budgeting just enough for the necessities, surprise expenses from unexpected events can be debilitating financially to those who have only just enough to scrape by.

“Spend what you can afford.” This is a word of advice that not everyone lives by. But the reality is that given today’s ever growing living standards/expenses while living wages do not grow proportionately, it is becoming increasingly difficult to live within one’s means.

The ‘American Dream’ they sell you on TV is not affordable anymore. Bankruptcy is commonly caused by not living frugally when it’s the logical thing to do.

Some examples of living beyond one’s means: leasing a Mercedes when you can barely afford a Toyota Corolla; buying a $5 Starbucks coffee every day when you could save a lot of money brewing your own coffee at home; living in the “high class” area of town instead of downgrading to a suburb where it’s more affordable; charging everything on your credit card and worrying about paying it off later; wearing the latest name brand clothes; also, going out, partying, buying drinks at the bar– it all adds up to a LOT of money.

Debt doesn’t always mean irresponsible spending. Job loss, illnesses, emergency spending can all contribute to financial struggle that can prevent debt payments and lead to bankruptcy. It’s a common scenario (especially during the pandemic) that one’s debt load stays the same but income dwindles due to factors outside of one’s control.

Nobody expects to get sick. When it does happen the medical bills can be crippling, despite having insurance (especially bad for the uninsured). What’s worse is that it can be very easy to have them pile up the longer that the individual needs to stay in the hospital. It’s a vicious cycle between needing to stay at the hospital to get better and yet needing to leave as the bills become even greater. Oftentimes, you will not see these debts on credit reports. The bills are also confusing themselves. You may have thought you paid what you owe and all of a sudden you’re in collections.

Most individuals’ main source of income comes from their job. And especially with many living from paycheck to paycheck, the interruption of their job due to a layoff or getting fired is detrimental to their financial health. While it can take months to find a job again, the bills don’t stop and the payments still pile up, leading to drowning in debt and ultimately likely filing for bankruptcy.

Divorce and separation often mean a significant loss of income and assets for either or both partners. Divorce can be expensive and additionally severely impact your living standards – new living conditions, new obligations for child support, alimony – can become priorities that affect your ability to meet your other obligations.

As the cost of mortgages spike up, Americans struggle even more to make payments. The more they struggle to pay their homes the less they are able to spend on other necessities and the more likely they will file for bankruptcy once things reach a breaking point.

Sometimes, Americans have to file for bankruptcy in order to avoid the foreclosure of their homes or other properties. Looking ahead, it appears the writing is already on the wall for real estate prices to take a nosedive, both commercial and residential. We’re not psychics over here, but with so many restaurants going out of business and people losing their jobs, it seems common sense that the extra retail vacancy space is going to negatively impact the commercial sector. Additionally, when people do not have jobs, they generally downgrade their living standards or stop paying rent completely– which consequently lowers residential values. We then find our economy in a similar situation as back in 2009 when values plummeted and homeowners found themselves paying mortgages that far outweighed even the value of the real estate itself (translation: equity has evaporated). In this situation it makes more logical sense to walk away than to keep up with loan payments.

Having a home is expensive. It doesn’t matter if it is a house that is owned or an apartment that is rented, the cost of living is a burden for many especially with needing to pay bills every month. With rising costs in air conditioner, heating, electric light, and other necessities, it can easily pave the way for someone to have to file for bankruptcy due to inability to pay it all.

There are many circumstances that can bring someone to file for bankruptcy. Everyone is susceptible to life’s challenges. The lucky ones will rise up from the ashes; the unlucky ones might find themselves on the streets homeless. For both groups, there’s hope and light at the end of the tunnel. Filing for bankruptcy can be the tool that saves your life.

Also, if you ever need to file for bankruptcy, the more important lesson is to learn better financial strategies going forward so you will never have to do it again. [Link to article, 5 Bankruptcy hacks to avoid filing]

At CN Law, in our twelve (12) years of business helping people with their Chapter 7 & Chapter 13 bankruptcy filings, we thankfully have never had a repeat client. For a lot of service businesses, not having repeat customers would be a terrible thing. When we deal with bankruptcies though, it is a sign of success and a track record that we are proud to share. This is not entirely by accident either. CN Law bankruptcy clients receive (as part of the package) free financial training and tools to help educate oneself to be more ‘fiscally fit.’

Contact us now for a consultation to discuss your financial situation. It’s absolutely free. (there’s also a chatbox at the bottom-right corner of your screen for immediate assistance!)

References:

Center for economics studies: https://www.census.gov/programs-surveys/ces.html

Chris T. Nguyen is a native Californian; born and

raised in Southern California. Chris attended the

University of Southern California...Read More